Your Buying in oregon to avoid sales tax images are ready. Buying in oregon to avoid sales tax are a topic that is being searched for and liked by netizens now. You can Download the Buying in oregon to avoid sales tax files here. Get all free photos.

If you’re looking for buying in oregon to avoid sales tax images information connected with to the buying in oregon to avoid sales tax topic, you have come to the right blog. Our website frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

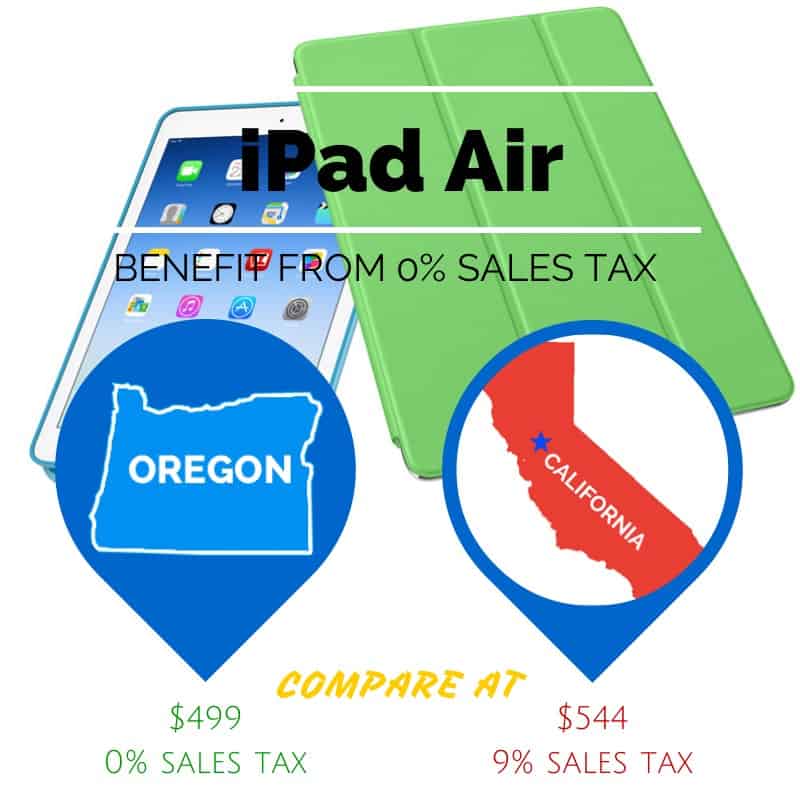

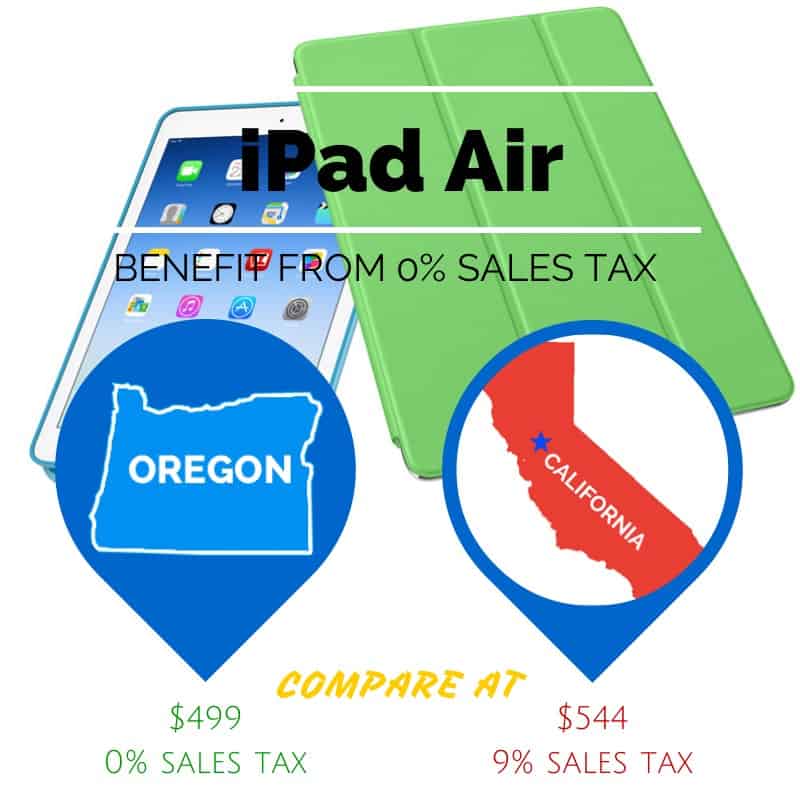

Buying In Oregon To Avoid Sales Tax. Like another commenter has said stores in Oregon are legally required to charge you WA state sales tax if they know that youre a WA resident. Of these five states Alaska and Montana allow local taxes to be charged under certain conditions. Only five states do not have statewide sales taxes. Oregons zero percent vehicle sales tax makes it a great state in which to purchase a car but non-residents will be expected to register their vehicles and pay the appropriate tax in their home state.

An Oregon Shipping Address Is The Key To Avoiding Sales Tax Opas From opas.com

An Oregon Shipping Address Is The Key To Avoiding Sales Tax Opas From opas.com

I assume you want to buy a car in Oregon to avoid the Washington sales tax on the car as Oregon has no sales tax. However as opoppa pointed out youll still pay room tax on lodging which as a general figure is about 10 on top of the quoted room price. Goods are purchased in another state that does not have a sales tax or a state with a sales tax lower than Washingtons. Only five states do not have statewide sales taxes. I purchased my ATVs from the same dealer he purchased his from and that dealer sales manager told me that even though I purchase the ATV is MS and they did not collect sales tax. May 29 2018 1 I am going to be visiting portland during 613 - 615 Assuming apple announce the new mac book pro this wwdc because there is a possibility apple store.

Online shopping and going to Oregon to avoid a sales tax is costing Washington millions.

But Oregon does have an Income tax which Washington does not. It is legally tax evasionfraud unless you pay the WA state and local use taxes on those purchases. Liv4thekill Jun 29 2006. Mac Basics Help and Buying Advice. There is no way to legally take advantage of no sales tax in Oregon unless you consume purchases in Oregon. Now 4 years later the job has moved back to Oregon.

Source: aeromarinetaxpros.com

Source: aeromarinetaxpros.com

Under Oregon law you can register your Daytona in Oregon if you are a resident of Oregon or if the Daytona is garaged in and used in Oregon. A friend who purchased a Honda ATV found this out the hard way when he recieved a notice in the mail that he owed about 700 in sales tax and a fine. The easiest and most straightforward way to do so is to buy a car in a state with no sales taxes and register the vehicle there. Now 4 years later the job has moved back to Oregon. Online shopping and going to Oregon to avoid a sales tax is costing Washington millions.

Source: cityobservatory.org

Source: cityobservatory.org

Not many stores actually do but it is a thing that could happen. Buying a new car in Oregon to avoid sales tax vehicle buy - Automotive -Sports cars sedans coupes SUVs trucks motorcycles tickets dealers repairs gasoline drivers. Only five states do not have statewide sales taxes. Oregons zero percent vehicle sales tax makes it a great state in which to purchase a car but non-residents will be expected to register their vehicles and pay the appropriate tax in their home state. Here is the bottom line according to Dick Hanna.

Source: sailingscuttlebutt.com

Source: sailingscuttlebutt.com

Of these five states Alaska and Montana allow local taxes to be charged under certain conditions. We bought a house here in Vancouver. Five states Alaska Delaware Montana New Hampshire and Oregon do not have a state sales tax so you could buy your items in those states. Goods are purchased in another state that does not have a sales tax or a state with a sales tax lower than Washingtons. It is legally tax evasionfraud unless you pay the WA state and local use taxes on those purchases.

Source: caranddriver.com

Source: caranddriver.com

I purchased my ATVs from the same dealer he purchased his from and that dealer sales manager told me that even though I purchase the ATV is MS and they did not collect sales tax. You may even be able to find devices that are new unopened or in-box. TPS as far as I know if you buy it from a dealer new or used the sale gets reported. Purchasing things in Oregon and bringing it home requires you to legally pay use tax in your state. Goods are purchased in another state that does not have a sales tax or a state with a sales tax lower than Washingtons.

Source: cityobservatory.org

Source: cityobservatory.org

Its only worth buying in OR if you dont register the bike race bike. Oregons zero percent vehicle sales tax makes it a great state in which to purchase a car but non-residents will be expected to register their vehicles and pay the appropriate tax in their home state. Because you live abroad you are under no obligation to pay US. Mac Basics Help and Buying Advice. TPS as far as I know if you buy it from a dealer new or used the sale gets reported.

Source: overturfvw.com

Source: overturfvw.com

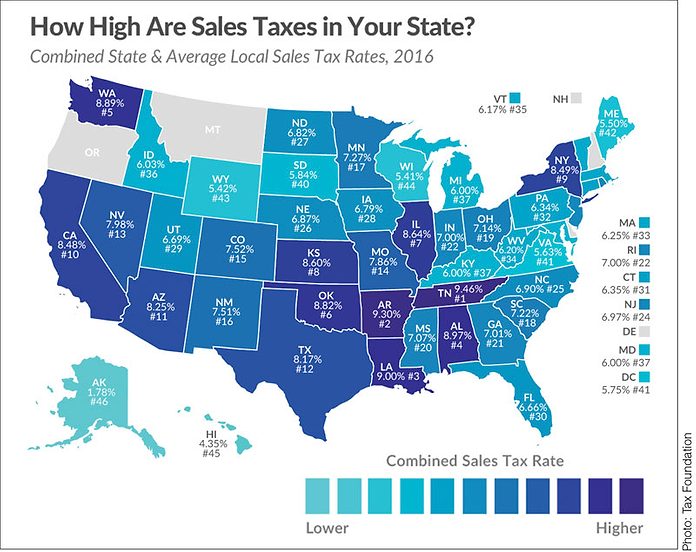

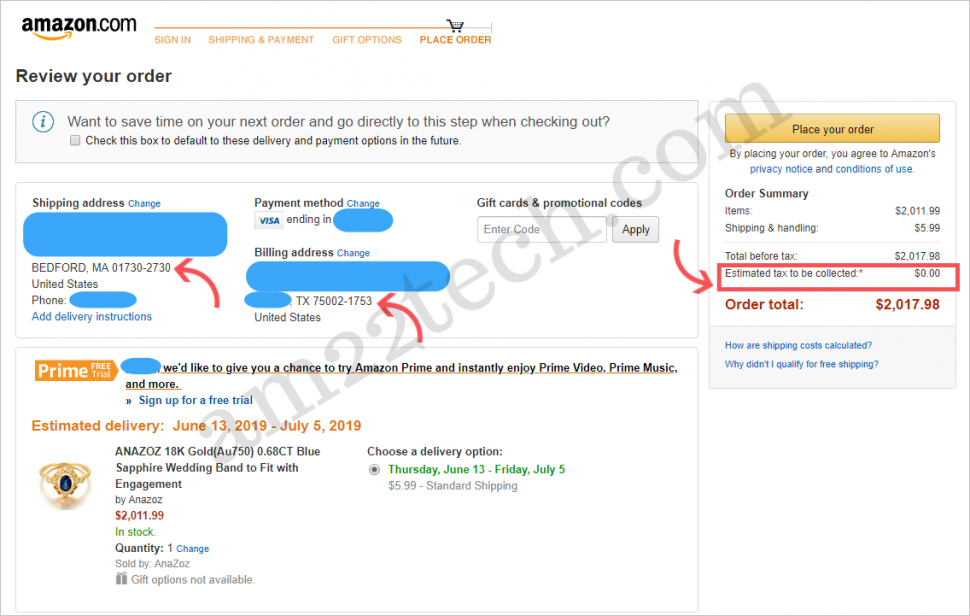

Goods are purchased in another state that does not have a sales tax or a state with a sales tax lower than Washingtons. Because of this we can help you to avoid taxes that you might end up paying if you used other services. You may even be able to find devices that are new unopened or in-box. Recently property tax has gone up 20 year over year. May 29 2018 2 0.

Source: opas.com

Source: opas.com

By ensuring that your. It is legally tax evasionfraud unless you pay the WA state and local use taxes on those purchases. Some housesneighborhoods are marginal but you get what you pay for. Goods are purchased in another state that does not have a sales tax or a state with a sales tax lower than Washingtons. When is use tax due.

Source: opas.com

Source: opas.com

When is use tax due. I assume you want to buy a car in Oregon to avoid the Washington sales tax on the car as Oregon has no sales tax. I purchased my ATVs from the same dealer he purchased his from and that dealer sales manager told me that even though I purchase the ATV is MS and they did not collect sales tax. Montana Alaska Delaware Oregon and New Hampshire. Doesnt stop people from doing it though.

Source: cityobservatory.org

Source: cityobservatory.org

There are five states that do not levy sales taxes-Alaska Delaware Montana New Hampshire and Oregon. Art collectors who seek to avoid the tax typically offer a recently purchased work to a museum in one of five states New Hampshire Oregon Alaska. But buying on the secondary market is still worth a mention. Like another commenter has said stores in Oregon are legally required to charge you WA state sales tax if they know that youre a WA resident. Of these five states Alaska and Montana allow local taxes to be charged under certain conditions.

Source: americanfarriers.com

Source: americanfarriers.com

Below is statement from the Dick Hanna their website who has car dealerships in the both Vancouver WA and Portland OR. Online shopping and going to Oregon to avoid a sales tax is costing Washington millions. In other words the Daytona can be registered in. You may even be able to find devices that are new unopened or in-box. Here is the bottom line according to Dick Hanna.

Source: oregonlive.com

Source: oregonlive.com

Oregon is the winner here because it has very appealing vehicle registration laws. Doesnt stop people from doing it though. I assume you want to buy a car in Oregon to avoid the Washington sales tax on the car as Oregon has no sales tax. May 29 2018 1 I am going to be visiting portland during 613 - 615 Assuming apple announce the new mac book pro this wwdc because there is a possibility apple store. When is use tax due.

Source: woodllp.com

Source: woodllp.com

Visit a State Without Sales Taxes Sales taxes are charged in 45 states as well as Washington DC. When you buy that car in another state to avoid paying the sales tax in California it is called tax evasion and could be tax fraud when you file your Ca state tax return. Oregon is the winner here because it has very appealing vehicle registration laws. Here is the bottom line according to Dick Hanna. But buying on the secondary market is still worth a mention.

![]() Source: opas.com

Source: opas.com

Art collectors who seek to avoid the tax typically offer a recently purchased work to a museum in one of five states New Hampshire Oregon Alaska. Under Oregon law you can register your Daytona in Oregon if you are a resident of Oregon or if the Daytona is garaged in and used in Oregon. When you do business with OPAS you can rest assured that your shipments will be routed through our sophisticated network focused on Oregon. We bought a house here in Vancouver. Below is statement from the Dick Hanna their website who has car dealerships in the both Vancouver WA and Portland OR.

Source: thereflector.com

Source: thereflector.com

Goods are purchased from someone who is not authorized to collect sales tax. I assume you want to buy a car in Oregon to avoid the Washington sales tax on the car as Oregon has no sales tax. Instant 9 pay raise when I slipped out of Oregons grasp sales tax. Set by the Oregon Department of Motor Vehicles DMV these depend on the type of vehicle you are purchasing. Art collectors who seek to avoid the tax typically offer a recently purchased work to a museum in one of five states New Hampshire Oregon Alaska.

Source: am22tech.com

Source: am22tech.com

By ensuring that your. Going to Oregon to avoid sales tax. Purchasing things in Oregon and bringing it home requires you to legally pay use tax in your state. Oregons zero percent vehicle sales tax makes it a great state in which to purchase a car but non-residents will be expected to register their vehicles and pay the appropriate tax in their home state. Art collectors who seek to avoid the tax typically offer a recently purchased work to a museum in one of five states New Hampshire Oregon Alaska.

Source: tricitiesbusinessnews.com

Source: tricitiesbusinessnews.com

I assume you want to buy a car in Oregon to avoid the Washington sales tax on the car as Oregon has no sales tax. Only five states do not have statewide sales taxes. Use tax is due if. When is use tax due. But buying on the secondary market is still worth a mention.

You may even be able to find devices that are new unopened or in-box. True Oregon has no sales tax so if you buy a 100 pair of shoes it will cost 100 not 109 - as it would in CaliforniaAnd other than in two towns in Oregon one of them is Yachats on the coast there is no tax on restaurant meals either. But Oregon does have an Income tax which Washington does not. In reality you are just committing tax evasion without getting. There is no way to legally take advantage of no sales tax in Oregon unless you consume purchases in Oregon.

Source: am22tech.com

Source: am22tech.com

Liv4thekill Jun 29 2006. Because of this we can help you to avoid taxes that you might end up paying if you used other services. May 29 2018 2 0. When you do business with OPAS you can rest assured that your shipments will be routed through our sophisticated network focused on Oregon. Only five states do not have statewide sales taxes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title buying in oregon to avoid sales tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.