Your Are va appraisals typically low images are ready in this website. Are va appraisals typically low are a topic that is being searched for and liked by netizens now. You can Find and Download the Are va appraisals typically low files here. Find and Download all free vectors.

If you’re searching for are va appraisals typically low pictures information related to the are va appraisals typically low topic, you have come to the right site. Our website frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

Are Va Appraisals Typically Low. But with proper planning your appraisal will go off without hitch. Particularly disturbing are some of the VA procedures that make it difficult to challenge mistakes as well as the impact the appraisals are having on other homes available for sale in the community. But low real estate appraisals are more common than you think. Reasons Why VA Loan Applicants Love The VA Appraisal Process.

4 Things To Know About Va Home Appraisals Jvm Lending From jvmlending.com

4 Things To Know About Va Home Appraisals Jvm Lending From jvmlending.com

Ask the seller to lower the purchase price. Having an appraisal come in low can be challenging for prospective VA buyers. A popular solution is to try to obtain a Reconsideration of Value ROV. However the appraisal comes in low at 95000 which becomes the new maximum home value. According to the Zillow Group Consumer Housing Trends Report 2018 among sellers who sold in the past 12 months and had a deal fall through 10 percent said it happened because the appraisal was lower than the purchase price. Lenders are going to lend whichever is less between the purchase price and the homes fair market value.

Here are some tips to make sure your appraisal goes as planned.

The VA appraisal doesnt have to be intimidating. More often than not an appraisal comes in around what the seller expected. Lenders are going to lend whichever is less between the purchase price and the homes fair market value. A low appraisal doesnt always mean a canceled deal. Some banks will engage appraisers who are from out of the area and dont have access to the local sales data he says. You just received a copy of the final report and the VA loan appraisal is too low.

Source: themortgagereports.com

Source: themortgagereports.com

How Often Do Home Appraisals Come In Low. The VA appraisal doesnt have to be intimidating. During an ROV the VA will reassess the property and see how much the true worth is. Particularly disturbing are some of the VA procedures that make it difficult to challenge mistakes as well as the impact the appraisals are having on other homes available for sale in the community. This makes most VA appraisals tougher to pass and it can slow down the process of buying a home.

Source: jvmlending.com

Source: jvmlending.com

NOTE- under VA guidelines you only have 48 hours after appraisal is issued but before it is uploaded to dispute the opinion of the appraiser. This makes most VA appraisals tougher to pass and it can slow down the process of buying a home. More often than not an appraisal comes in around what the seller expected. Consider these three strategies for handling a low appraisal value. All the stars are aligned.

Source: veteransunited.com

Source: veteransunited.com

More often than not an appraisal comes in around what the seller expected. All the stars are aligned. Ask the seller to lower the sales price to equal the appraisal value. In that case the appraiser is forced to use data that is fed to them from other sources and may or. Consider these three strategies for handling a low appraisal value.

Source: veteransunited.com

Source: veteransunited.com

A popular solution is to try to obtain a Reconsideration of Value ROV. Consider these three strategies for handling a low appraisal value. Ask the seller to lower the purchase price. VA appraisals are a key part of VA loan approval and are required by the Department of Veterans Affairs for VA purchase and cash-out refinance loans. But with proper planning your appraisal will go off without hitch.

Source: themortgagereports.com

Source: themortgagereports.com

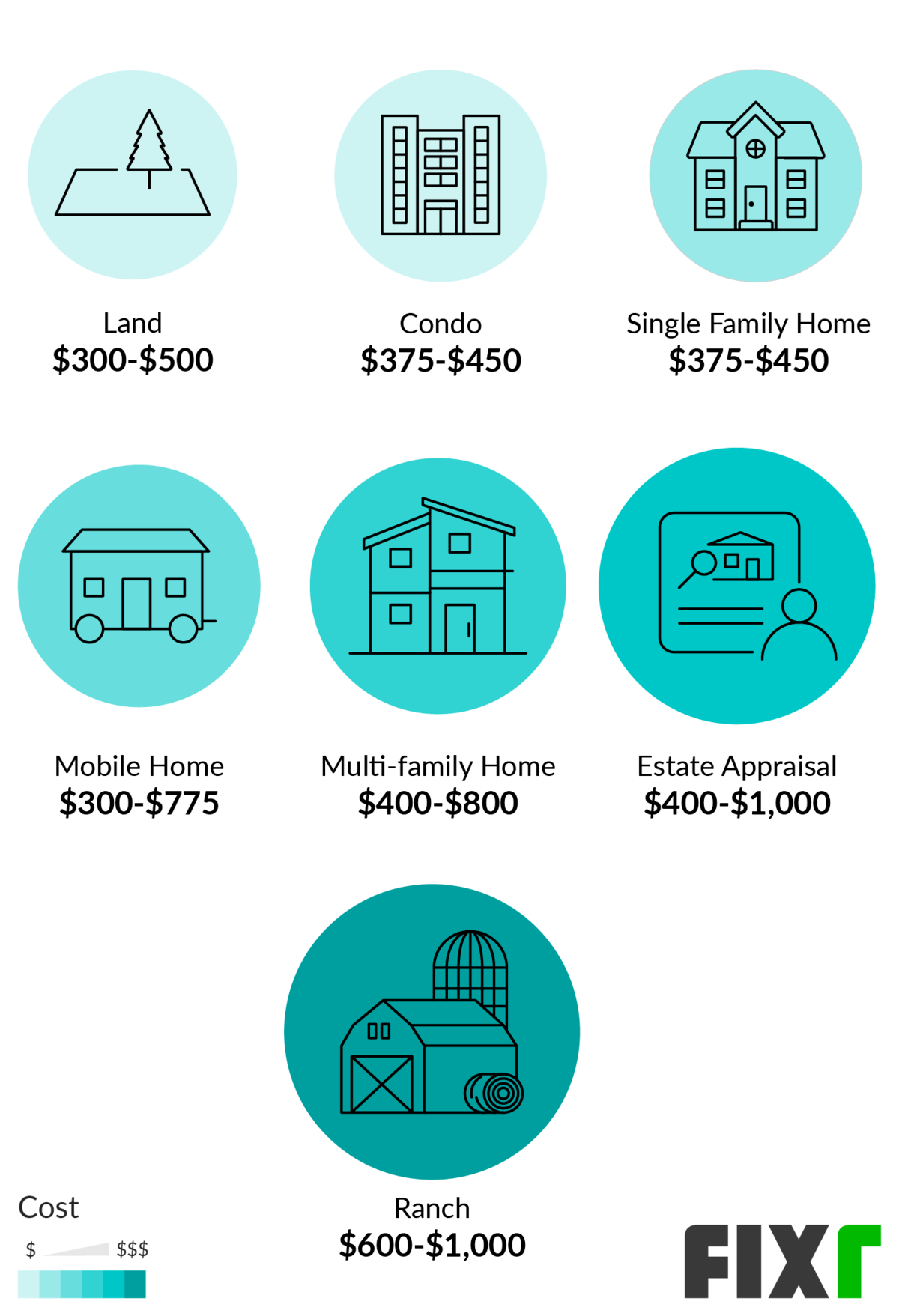

Appraisals can throw a wrench in your financing plans and wreak havoc with your lender. Appraisal fees generally vary by location and home type single-family vs. Walk away from the purchase. Instead its designed to protect the borrower ensuring the home is safe sanitary and fairly priced. All the stars are aligned.

Source: veteransunited.com

Source: veteransunited.com

Walk away from the purchase. Consider these three strategies for handling a low appraisal value. A popular solution is to try to obtain a Reconsideration of Value ROV. In that case the appraiser is forced to use data that is fed to them from other sources and may or. VA appraisals are a key part of VA loan approval and are required by the Department of Veterans Affairs for VA purchase and cash-out refinance loans.

Source: lendingtree.com

Source: lendingtree.com

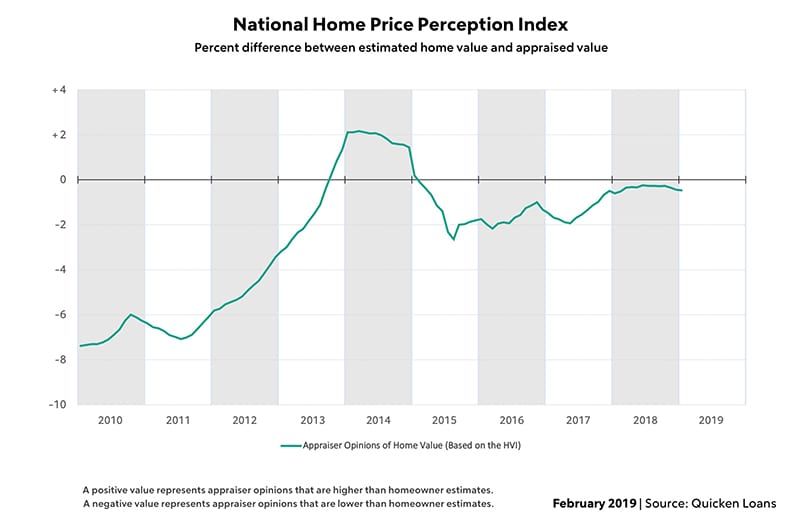

The VA appraisal doesnt have to be intimidating. Make up the difference in cash. In addition the low appraisals impact the value of future community sales costing the builders significant money. Click to see todays VA rates. According to Fannie Mae the vast majority of appraisals confirm contract price with the share peaking at 98 in 2007.

Reasons Why VA Loan Applicants Love The VA Appraisal Process. Having an appraisal come in low can be challenging for prospective VA buyers. However the appraisal comes in low at 95000 which becomes the new maximum home value. But with proper planning your appraisal will go off without hitch. More often than not an appraisal comes in around what the seller expected.

Source: benefits.com

Source: benefits.com

With mortgage rates low and home sales rising the VA home loan is an important. Petition the VA for a Reconsideration of Value. It sometimes means you have to pivot and renegotiate. Lets say the contract price is 200000. Read on for our tips on how to handle a low appraisal.

Source: assurancemortgage.com

Source: assurancemortgage.com

VA appraisals are a key part of VA loan approval and are required by the Department of Veterans Affairs for VA purchase and cash-out refinance loans. A VA loan cant be issued for more than the appraisal value so a low appraisal can send buyers scrambling. That means if youre under contract at 250000 but the homes appraised value is 225000 youve got some decisions to make. But low real estate appraisals are more common than you think. They may now have to scramble to make up the difference that the VA will.

Source: nerdwallet.com

Source: nerdwallet.com

Instead its designed to protect the borrower ensuring the home is safe sanitary and fairly priced. All the stars are aligned. The appraisal value falls short of the loan amount. Following increased appraisal scrutiny the share dropped towards 90 and is now closer to 95. Ask the seller to lower the purchase price.

Source: militarybenefits.info

Source: militarybenefits.info

But with proper planning your appraisal will go off without hitch. A VA appraisal coming in low can bring some problems for buyers. During an ROV the VA will reassess the property and see how much the true worth is. All the stars are aligned. Let the seller know the appraisal value came in below the sales price.

Source: veteransunited.com

Source: veteransunited.com

If the appraisal will be low in a VA transaction the appraiser must notify the lender andor agents involved and give them the opportunity to present a case for higher value. However the appraisal comes in low at 95000 which becomes the new maximum home value. In addition the low appraisals impact the value of future community sales costing the builders significant money. The buyer has 40000 for a. If the appraisal will be low in a VA transaction the appraiser must notify the lender andor agents involved and give them the opportunity to present a case for higher value.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

Multifamily for example but the typical VA appraisal cost is usually between 400. But low real estate appraisals are more common than you think. You just received a copy of the final report and the VA loan appraisal is too low. A VA loan cant be issued for more than the appraisal value so a low appraisal can send buyers scrambling. VA appraisals are a key part of VA loan approval and are required by the Department of Veterans Affairs for VA purchase and cash-out refinance loans.

How Often Do Home Appraisals Come In Low. The buyer has 40000 for a. Walk away from the purchase. Ask the seller to lower the purchase price. Ask the seller for a price reduction.

Source: fixr.com

Source: fixr.com

Let the seller know the appraisal value came in below the sales price. If the buyer has the option of canceling the contract when the appraisal comes in low that gives the buyer leverage with the seller to renegotiate the price down. Following increased appraisal scrutiny the share dropped towards 90 and is now closer to 95. It sometimes means you have to pivot and renegotiate. A VA loan cant be issued for more than the appraisal value so a low appraisal can send buyers scrambling.

Source: assurancemortgage.com

Source: assurancemortgage.com

Appraisals can throw a wrench in your financing plans and wreak havoc with your lender. It sometimes means you have to pivot and renegotiate. A popular solution is to try to obtain a Reconsideration of Value ROV. During an ROV the VA will reassess the property and see how much the true worth is. A VA loan cant be issued for more than the appraisal value so a low appraisal can send buyers scrambling.

Source: veteransunited.com

Source: veteransunited.com

Here are some tips to make sure your appraisal goes as planned. According to the Zillow Group Consumer Housing Trends Report 2018 among sellers who sold in the past 12 months and had a deal fall through 10 percent said it happened because the appraisal was lower than the purchase price. Particularly disturbing are some of the VA procedures that make it difficult to challenge mistakes as well as the impact the appraisals are having on other homes available for sale in the community. What happens if VA appraisal is low. The VA appraisal doesnt have to be intimidating.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title are va appraisals typically low by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.